[ad_1]

CBDC vs. Crypto

No matter how much anyone might love Bitcoin or crypto and for what it stands – no central authority or control – the fact is that just about everyone will prefer a government backed CBDC that is legal tender than a corporate crypto like Circle.

CBDC are government-backed, legal tender and on par 1-to-1 with a national currency that is already used as everyday money and is generally considered as a point-of-reference to purchasing power and value. Simply put, a one US dollar note will be exactly as one CBDC/Digital Dollar, soon-to-be-issued by the US Federal Reserve, according to ”Project Hamilton”, which is a joint exploration by the Federal Reserve and Massachusetts Institute of Technology’s Digital Currency Initiative.

According to CBDCtracker.org, the first ever nationwide functional CBDC is the “Sand Dollar” of the Bahamas, followed by the 2021 launch and imminent roll out early 2022 of Jamaica’s “Jam-DEX”. Around the same time in October 2021, Nigeria launched their CBDC by the name eNaira, issued by the Central Bank of Nigeria, backed by law and legal tender in Nigeria.

The Digital Yuan is still in the pilot phase – currently available in 23 cities and used by a fifth of the Chinese population – but it has proven to be functional so far. Unlike CBDC standards, it is not a blockchain-based decentralized ledger (DLT) but rather a “centralized” CBDC, issued and supervised by the “People’s Bank of China” (China’s Central Bank).

Bitcoin is legendary; the first crypto that rose from obscurity to the most used crypto of all times as well as dominating 50% plus of the crypto market cap, pushing it to $3 trillion sometime in November 2021. The disadvantage of Bitcoin – or any crypto for that matter – is being unregulated, unstable and volatile in value. Even “stable-coins” have not lived up to their name. TerraUSD which was pegged nearly exactly to the US$, crashed this year on May 9th, taking along its sister coin Luna. The reverberations of this stable-coin implosion will be felt for many years to come by crypto investors that lost all their money and regulators that are now more scrutinizing and reluctant to regulate crypto, giving preference to their national and government-backed fiat money.

But even crypto diehards – and they will never admit – always instantly calculate their crypto holdings in “fiat money”, that is, real everyday cash because 1 Bitcoin can/could be anywhere from $1 to $1 million (if we are to listen to the prophets and prophecies of doom or gloom). If we look back at the double digit swings of just the past 5 years, Bitcoin was valued a mere $1,000 in January 2017 and then peaked at $68,790 on 7th of November 2021, currently bouncing around the $20,000 level.

The problem with Bitcoin and any crypto is that it’s very volatile and cannot really be “tempered”, it’s mostly subject to the wild swings of supply and demand, and that’s it. Macroeconomic factors such as GDP, inflation or unemployment figures, don’t really play a role in Bitcoin’s price movements, except for bad news. War in Ukraine, cost-of-living, food and energy crises might push the Bitcoin price up or down, depending on the short-lived rationality of contributing factors. It will then either spike as a temporary “safe-haven” for capital as a “value store”, or crumble due to negative press coverage or government press releases in relation to crypto regulation. Most cryptos then follow in tandem, if Bitcoin is down, you can be sure that Ethereum, Tether, XRP, USDC, Cardano, Solana, etc. will be down as well, like brothers in a brotherhood or soldiers in a battle.

For those who are not really familiar with crypto or Bitcoin, should know that there are many HODL’ers (hold-on-for-dear-life) that hold on to their crypto’s for the long term, only selling when the time is right, when there is massive breakout or astronomical spike like for example Dogecoin, a “joke” crypto that started in 2013 and has since increased in value by a mind-boggling 33400% (yes, that’s 33.4 thousand percent, just to be clear).

The official title for Bitcoin HODL’ers is “Bitcoin Whales” because they own so much crypto, they can actually make crypto markets move, along with their “partners-in-crime”, the Bitcoin mining companies. There’s just a vested interest by both to “manipulate” the value of Bitcoin which, for Bitcoin Whales means more money, and for miners, more mining and much more money as well. Currently, the cost of mining one Bitcoin is estimated by JP Morgan to be around $13,000, well below the current selling price of around $20,000 per Bitcoin.

“As long as the price of Bitcoin holds above this cost, a mining operation remains profitable, and many market observers suggest that production costs also can serve as the lower bound of Bitcoin’s price range in a bear market”

Copyright – Decrypt – article dated July 16th 2022

JP Morgan strategists, led by Nikolaos Panigirtoglou wrote:

“While clearly helping miners’ profitability and potentially reducing pressures on miners to sell Bitcoin holdings to raise liquidity or for deleveraging, the decline in the production cost might be perceived as negative for the Bitcoin price outlook going forward”.

It is not to say that all Bitcoin whales and miners are criminals, it’s just that by colluding and collaborating, the price of Bitcoin can somehow be influenced and controlled.

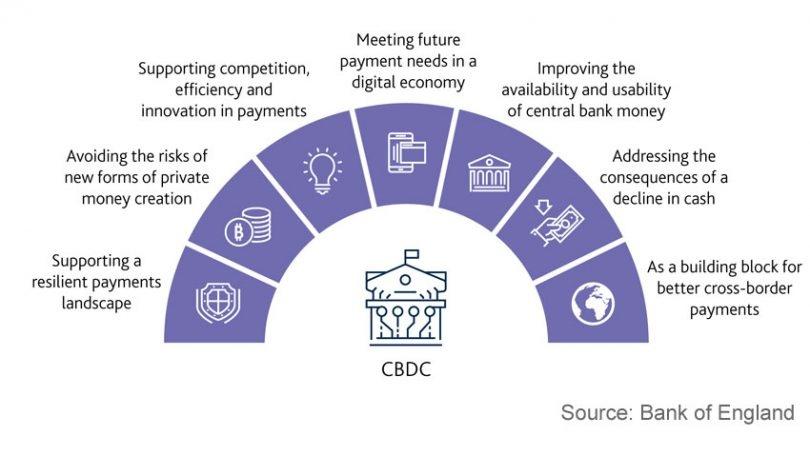

CBDC – Central Bank Digital Currency – are issued by Central banks and currently there are well over 100 countries and more than 90% of the world’s Central Banks contemplating, exploring and piloting the viability of CBDCs. At the centre of CBDC issuance is control, regulation, privacy, data and even more importantly, the very survival of the legacy banks and banking systems in the first place. If everyone can just deposit their money with the government for free, who needs banks that can charge fees – ranging anywhere from reasonable to exorbitant – for banking and financial transactions?

CBDCs are defined as “programmable money” that could be used as an instant “kill switch” at any time or simply controlled at will by any government with bad intentions. Sounds dystopian or far-fetched? Think again. In a revealing article published in the Guardian newspaper by Louisa Lim and Julia Bergin on the 28th of August, there’s proof of a deepening global trend towards government interference and “digital authoritarianism” as governments use access to the internet as a weapon against their own people which can have huge ramifications in society and further afield in governance, freedom of press and liberty. As collateral damage, shutting down the internet can collapse healthcare (which is heavily dependent on accurate and real-time information) as well as instantly paralyze money, banking and finance such as preventing access to ATM cash (one of many examples). According to “Access Now” which is a NGO that tracks global connectivity, in 2021 alone there were 182 internet shutdowns in 34 countries with India leading the pack with 106 internet shutdowns, that’s more than the rest of the world combined. For the full story, please click here to read the Guardian article.

China is currently leading CBDC implementation and usage with their e-Yuan (a/k/a Digital Yuan) and their “Social Credit System” that enables the Chinese government to evaluate and determine “trustworthiness” of any individual, business or government institution, giving Chinese government the possibility to “whitelist” or even “blacklist” dissenters. Anywhere from restricting travel, to jobs’ access or even curtailing internet use by only allowing for “slow internet”; Who would have thought that a “slow internet” could be a form of punishment in the digital age?

It is somehow strange and controversial that China’s Communist Party – officially “The National People’s Congress of the People’s Republic of China” – the highest state organ of power consists of over 100 billionaires (in US$ terms). Surely, that kind of money did not come from hard work in agriculture or fishing, but more likely from massive industry production and more recently, tech entrepreneurship.

China is a hybrid communist/capital business model, depending largely on where you live and earn your living. Shenzhen, a small fishing village only a mere 40 years ago, has now become China’s Silicon Valley, home to tech giants such as Tencent. Beijing is home to Baidu and other tech companies that are proliferating across the Chinese tech landscape as the Chinese government is gradually moving away from export production to a service economy with a strong focus on tech.

Much to the dislike of the Americans, China is gradually catching up on GDP and is expected to overtake the United States as the biggest economy of the world (projected to be sometime around 2030), a revered position held by the Americans since the 1920s (in GDP terms), and strengthened/consolidated ever since 1890 when it overtook the British Empire as the world’s most productive economy.

Sometime in September 2017, Jamie Dimon, the CEO of Wall Street powerhouse JP Morgan, called Bitcoin a “fraud”. Just about 3 months later, Bitcoin hit an all-time high of nearly $20,000 and then crashed shortly thereafter which resulted in the first ever “crypto winter”. Ever since Jamie’s Bitcoin takedown (and many others that followed), he has flip-flopped between love and hate for Bitcoin, at times bashing crypto and then regretting his statements in mainstream media.

JP Morgan in the meanwhile has built up a sizeable presence in crypto and digital assets with crypto trading desks strategically operating in different parts of the world in order to take advantage of crypto movements in value, but more importantly, to be at the forefront of decentralized finance and blockchain technology advancements. Through their wholly-owned subsidiary Onyx, launched in 2020 and led by CEO Umar Farooq, who is also the JPM Global Head of Financial Institution Payments, JP Morgan is aiming to strengthen its position in the crypto world and has in the meantime launched its own JP Morgan Coin.

Onyx is a J.P. Morgan business unit that leverages cutting-edge technologies like Blockchain to develop innovative products, platforms and marketplaces.

Copyright 2022 – JP Morgan/Onyx homepage

Apart from the formidable JP Morgan, many Wall Street banks and financial institutions are joining the crypto, blockchain and decentralized finance trend, applying legacy banking combined with existing financial networks to be at the forefront of DeFi, when that becomes a functional reality. At present however, DeFi is cumbersome and complicated, with UX being deplorable and substandard. Accessing DeFi and crypto wallets requires tech literacy, long alphanumeric keys, recovery passphrases (hand-written on ordinary paper), hot or cold storage, etc.

Coinbase and Bin

ance are two major digital exchanges and crypto trading platforms that are making big improvements in crypto user-friendliness and the entire customer experience so that many more retail investors can access, trade and store their crypto, digital assets and NFTs. Big banks on their part are jumping on the crypto bandwagon, however their focus is more on institutional and corporate clients, dealing primarily in transactions that are in the $millions and $billions.

Whatever happens on the regulatory front, crypto is here to stay and Bitcoin will never go out of style, even if outlawed by the major economies of the world. There will always be Bitcoin and crypto trading, simply because it’s borderless and decentralized. No country, government or authority can control crypto, only make it illegal to own, trade or hold should that ever be the case or become law. The counter to crypto is CBDC, and that’s the most compelling reason that Central Banks around the world are exploring and experimenting with CBDCs.

Once CBDCs become mainstream, there will be widespread adoption of both CBDCs and crypto – specifically “stable-coins” – as then the functionality and secure payment format will have been proven, thus making it feasible as everyday money.

The biggest unknown however, will governments eventually make crypto illegal? This question remains unanswered and disputed from every angle but then again, will governments around the world cede control to “borderless” crypto when their national CBDCs are fully functional and controlled? To be continued.

Centralized vs. Decentralized

Centralizing the Decentralized is just about the only way forward as a “compromise” to ensure mainstream adoption of crypto and DeFi. Of course, crypto diehards will insist on their mantra that crypto is decentralized by default, there just cannot be any central authority in accordance with Satoshi’s view.

In theory perhaps, in reality not. Any dApp or decentralized platform will have some governance in the form of a company, authority or DAO (Decentralized Autonomous Organization).

In relation to a DAO, in legal terms and in a regulatory framework, who takes responsibility and/or is liable when things go wrong?

The coder, algorithm or both?

This dilemma opens up a big challenge to decentralized finance and the proliferation of DAO’s. In a world of trade, commerce and business, the law ensures that contracts and transactions follow a certain standard pattern of legality and any disputes can be argued over in court. Governments on their part have passed laws and enacted legislation to ensure that certain aspects are governed by law, in particular consumer protection. This is prevalent in banking, finance, insurance, commerce, retail, utilities, data protection, privacy and so on. The consumer is protected by default and laws ensure that the providers of services and goods are liable and subject to compensation and/or legal action. GDPR takes this to another level where fines are usually in the $millions and can easily escalate into the $billions. Big tech such as Google and Facebook are very aware of data breaches and anti-competitive practices, and they have been fined $billions to date.

Decentralized finance is “trustless”, meaning there’s no need for trust as it is coded into the blockchain protocol that underpins the transaction. For those who are not familiar, blockchain is a digital ledger on world-wide networks of nodes where transactions get validated and are irreversible. In short, blockchain is tamper-proof, time-stamped and transparent.

The purpose of law in its simplest form is to ensure that everyone adheres to the same rules and regulations, creating a standard for interaction and trust.

Trust is crucial in any aspect of a transaction, as it ensures that we get what we bargained for or bought. Apart from barter, there is always a financial concept to any transaction, whether buying goods or services or simply donating to a good cause. The underlying aspect of any transaction is trust and therefore, the whole financial world values trust the most.

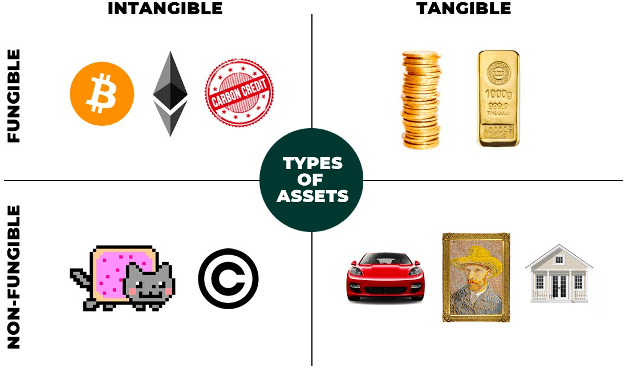

NFT and Digital Assets on Blockchain

Since 2020, NFT has become the buzzword of digital art and the entire NFT market has witnessed massive hyper-growth within a mere 2-year time span. And there is a good reason for that, NFTs provide for digital rights, provenance and artists’ royalties in the same way as in the music industry for example. Every time artwork is sold as an NFT, the artist or creator thereof receives royalties in the form of a consistent crypto payout as embedded in the underlying smart contract. Unfortunately, there have been some issues and hick-ups with NFTs having been sold at world renowned auctions houses such as Christies where the NFT creator had access to code keys and thus the buyer did not own the NFT own the art exclusively and outright. Copies were made and sold pretty much illegally and that cast a doubt of trust in the entire NFT art market.

Strides have been made to counter this problem and even more effort has been canvassed in the art world for artists to be rewarded for their artwork perpetually through digital royalties coded in smart contracts on Ethereum. The argument is rather simple, if musicians are protected by copyrights for the music they created, why not artists – and their artworks – such as painters, sculptors or photographers (the ones that are not owned/contracted by Getty Images)?

Since digital art on blockchain – going by the distinctively unsexy name of “non-fungible token” – is currently in vogue, every effort is being made to solidify the regulatory framework surrounding NFTs, alas it’s not global yet. If anything, since blockchain is irreversible and thus prevents fraud, provenance of any digital artwork can be proven and the digital title of ownership confirmed in a court of law. The biggest challenge however, excluding NFTs, is connecting the art to the digital title. It’s almost impossible to embed a tracking device in a Picasso that links the painting to a digital title although many ingenious ways are currently being devised that will make it possible in the near future for art to be linked as proof of ownership to the pertinent artwork as the one specified in the digital title. As a comparison, diamonds are already being digitally certified on blockchain on the basis of the 4 main characteristics of cut, color, clarity, carat and other discerning characteristics such as price, provenance and specialist’s reports and certificates issued by trustworthy institutions such as the Gemological Institute of America.

Other digital assets on blockchain such as property, patents, copyrights, film and music rights, etc. present their own challenges which are currently being addressed by governments across the world. The key factor of global regulation is the standardization of tokens, as proposed by Berlin-based International Token Standardization Association (ITSA), and interoperability of blockchain, without which there cannot be a global framework for regulation and legal conformity.

In the world of FinTech and finance, there is a lot of talk as well as action on STO – Security Token Offering – which is similar to financial instruments such as shares, bonds and derivatives used in today’s financial world. The main difference is that there is a massive paper trail and back-end office admin with traditional finance which is not the case with STO’s, as all data is stored on DLT or blockchain (except for investor info and public disclosure via brochures, magazines, newspapers, white papers and other publications).

STO’s are the way forward in the digital world and the financial industry is making big strides to incorporate blockchain in all aspects of financial transactions.

On this point, it is important to note the difference between DLT and blockchain which is public, whereas DLT – Digital Ledger Technology – is private and permissioned, meaning that anyone wishing to join a particular DLT will have to request and be granted permission by the governing board or existing members.

In banking and finance, which always has been a closed and exclusive network of bankers, the most commonly used DLT is R3 Corda, widely recognized as the best-in-class DLT platform for banking and financial services.

DeFi is the exact opposite of CeFi – Centralized Finance – which means central control by its governance and participants, the bank and financial institutions that control the financial markets along with the Central banks, and many fringe or shadow organizations such as BIS – Bank for International Settlements – based in Basel, Switzerland that exert great influence and financial supervisory on policymaking and regulation of money, finance and banking.

The problem with DeFi is that it is still nascent, underdeveloped, experimental and requires strong technological skills to navigate the dApps and coding functions of blockchain. Other factors and disadvantages are speed, scalability, complicated crypto wallets incorporating lengthy alphanumeric keys and developing a friendly user-interface.

Decentralized applications, commonly known as “dApps” are digital applications that run on blockchain protocol over a network of nodes (i.e. computers) as opposed to relying on a single computer mainframe or cloud structure, thus making dApps decentralized, free from control or interference by a central authority.

The vast majority of dApps use Ethereum and its smart contracts function to disrupt business models or invent new ones, and even though it is a growing movement of applications, there are not too many that have reached the convenience and usability states as big tech such as Google.

For all the above reasons, regulating digital assets on blockchain presents an ongoing challenge that slows the proliferation of “tokenization”, the new frontier in FinTech and finance.

Decentralized finance will become a reality, but it will be centralized at first, until mainstream adoption of crypto and CBDCs is global, and DeFi becomes convenient, user-friendly and prevalent in society.

[ad_2]

Source_link