[ad_1]

Regardless of the Gulf area being dwelling to the biggest Indian expatriate group with long-standing relations, its huge financial potential stays unexplored. International locations of Gulf Cooperation Council (GCC) consisting of United Arab Emirates (UAE), Saudi Arabia, Oman, Qatar, Kuwait and Bahrain with over 8.5 million non-resident Indians, represent 65 per cent of whole NRIs.

GCC was the supply of the biggest international inward remittances, garnering 30 per cent of whole remittances (RBI Bulletin, July 22 p 143). Given India’s rising commerce engagement with GCC and its dependency on petroleum merchandise, the significance of pursuing a complete financial cooperation settlement (CEPA) with GCC can’t be overestimated. Eighteen years after India’s signing of a framework settlement on Financial Cooperation with GCC, hardly any worthwhile progress has been made regardless of holding two rounds of negotiations in 2006 and 2008.

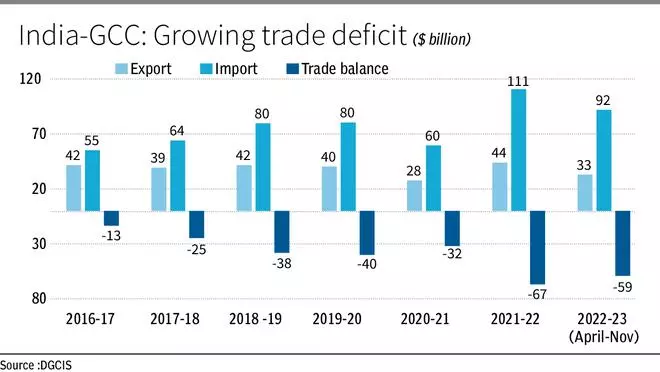

Commerce deficit with GCC

India’s commerce deficit with GCC soared from $13.4 billion in 2016-17 to $66.8 billion in 2021-22. Among the many GCC nations, the UAE is India’s main vacation spot for exports value $28 billion, adopted by Saudi Arabia ($8.8 billion), Oman ($3.1 billion), Qatar ($1.8 billion), Kuwait ($1.2 billion) and Bahrain ( $900 million) in 2021-22.

India had the very best commerce deficit (2021-22) with Saudi Arabia ($25.3 billion), adopted by the UAE ($16.8 billion), Qatar ($11.4 billion), Kuwait ($9.8 billion), and Oman ( whereas India had a commerce surplus of $147 million with Bahrain.

In 2021-22, India had a commerce deficit with GCC nations in petroleum merchandise, pearls, treasured and semi-precious stones, gold, fertilisers, plastic uncooked supplies, natural chemical compounds, aluminium merchandise, inorganic chemical compounds, bulk minerals and ores, dye intermediaries, amongst others.

India imported 87 per cent of oil consumed throughout April-September 2022. Petroleum and petroleum merchandise are amongst India’s high imports from GCC accounting for 66 per cent of its whole imports of $119 billion in 2021-22. India is a provider of agricultural and manufactured merchandise to GCC and loved a commerce surplus in agricultural merchandise ($5 billion), engineering items ($4 billion), textiles ($3.4 billion), digital and software program merchandise ($2 billion) and pharma merchandise ($488 million) in 2021-22.

GCC profile

The GCC nations are main exporters of petroleum and mineral oils accounting for about 70 per cent share of their exports, contributing to a major commerce surplus of $273 billion in 2021 with their exports of $715 billion far exceeding their $442-billion imports.

Different main GCC exports embody derivatives of petroleum by-products, reminiscent of plastics (5.2 per cent), natural chemical compounds (3.3 per cent), and fertilisers (1.4 per cent). Nonetheless, attributable to fall in world oil costs, GCC exports declined from $1.1 trillion in 2013 to $650 billion in 2020 whereas its imports diminished marginally from $567 billion to $476 billion throughout the identical interval. Consequently, it led to say no in GCC exports’ share on the earth market from 5.7 per cent in 2013 to three.3 per cent in 2021.

Nonetheless, owing to a revival in oil costs in 2022, the World Financial institution expects the economies of GCC to develop by 6.9 per cent in 2022, earlier than moderating to three.7 per cent and a pair of.4 per cent in 2023 and 2024. The exterior stability surplus is anticipated to achieve 17.2 per cent of GDP. In a situation of India’s oil dependency, India’s commerce deficit with GCC is anticipated to rise sharply, mirroring their beneficial exterior stability.

Main GCC imports (2021) consist of electrical equipment and tools (11.2 per cent), equipment and mechanical equipment (11.1 per cent), autos (8.4 per cent), and pharmaceutical merchandise (3.1 per cent). Saudi Arabia has the very best exports of $268 billion adopted by the UAE ($240 billion), Qatar ($80 billion), Kuwait ($57 billion), Oman ($56 billion) and Bahrain ($12 billion).

For mutual profit

India provides loads of complementarities in commerce with GCC nations, as these nations present for India’s vitality safety, whereas India ensures their meals safety.

In addition to, India, the world’s quickest rising and huge market of 1.4 billion individuals, provides immense financial alternatives.

In view of the great potential for commerce, India and the GCC have to transcend the normal Free Commerce Settlement (FTA) and embody investments and companies as part of complete financial partnership.

India and the UAE hammered out a Complete Financial Partnership Settlement in document time. The CEPA was concluded was concluded on February 18, 2022, merely six months after the graduation of negotations, on September 2021. Beneath the CEPA, that got here into pressure on Might 1, 2022, Indian merchandise bought preferential market entry to the UAE on over 97 per cent of its tariff-lines accounting for 99 per cent of India’s exports to the UAE in worth phrases largely for labour intensive exports, moreover enhanced entry to over 111 sub-sectors from 11 broad companies sector. In a quickly rising multipolar world, early and efficient implementation of CEPAs would offer a lift to India and GCC nations.

The author is Director, Indian Institute of Plantation Administration, Bengaluru. Views are private

[ad_2]

Source_link