[ad_1]

The worldwide diamond trade is dominated by two large firms which can be so highly effective they successfully management the costs at which all the dear stones are traded in nearly each market.

London-based De Beers controls an unimaginable 34.5 p.c of the US$140 billion international diamond market with Russian miner, Alrosa, not far behind on 28.4 p.c.

From when it was shaped in 1888 to the daybreak of the twenty first Century, De Beers alone managed as much as 85 p.c of the market. The corporate helped the trade develop in international locations like India, in addition to supporting the financial progress of nations like Botswana and Namibia, based on Blue Star Diamonds Managing Director Arnav Mehta.

“It managed the availability of pure diamonds for over a century, defending them from the volatility that different commodities have,” he tells The CEO Journal.

Nowadays, elevated competitors and regulatory change has altered the panorama throughout numerous markets, however solely to an extent. “Management upstream could be very monopolistic,” Mehta displays. “The worth they decide is the worth we’ve all needed to settle for for many years.”

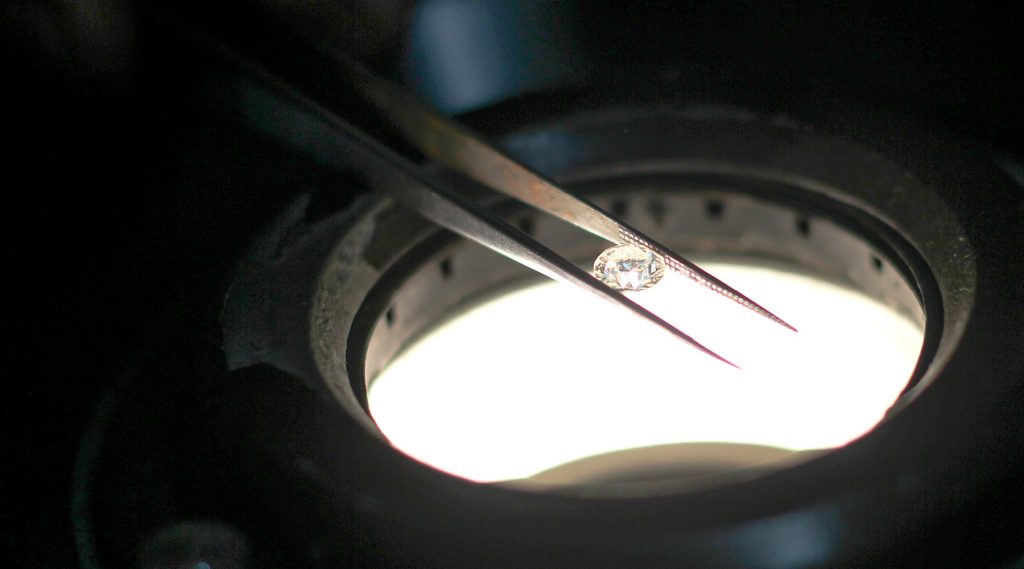

The Mumbai-based Blue Star Diamonds has been in operation for 56 years, sourcing uncooked diamonds from these miners earlier than sharpening and reducing them into beautiful items that may adorn high-end jewellery on each continent.

We realized that the fashionable client wants extra customization, a novel trying diamond.

Purely jewels

However Blue Star doesn’t often make the jewellery itself, one thing that surprises quite a lot of observers. Certainly a glittering jewel crafted right into a necklace or ring would make an even bigger revenue than simply the stone by itself?

“Folks typically surprise why we don’t try this ourselves,” Mehta says with a smile. “The reply is that in most international locations, together with america, China and the entire of Europe, diamonds are exempt from import obligation, whereas jewellery just isn’t.

“When you’ve got a $5,000 diamond that you simply’re placing on a hoop, the gold might be solely price $300. So, why would you need to pay obligation on the entire $5,300? You’ll be able to simply purchase the diamond, get the mounting individually and have it set your self.”

Mehta joined the enterprise straight after finishing a enterprise and know-how diploma at College Faculty London in 2004. “It was began by my grandfather, after which his three sons took over and I’m the third era.”

Blue Star is a part of the A-Star Alliance, which consists of three firms owned by the household – Blue Star Diamonds, Arjav Diamonds and Aurostar – and has operations in a number of international locations. The alliance was shaped to optimize synergies between the three teams for his or her mutual profit.

“We’re primarily a Hindu undivided household with every of us chargeable for totally different entities globally,” Mehta provides. “Blue Star Diamonds falls below my remit so I’m taking care of all of the Indian operations.”

A world household

Blue Star has over 2,000 workers unfold throughout its manufacturing and distribution presence throughout america, China, Australia, United Arab Emirates, Belgium, India and Botswana.

“During the last 10 years, India has slowly taken market share from all different sharpening facilities comparable to Belgium, South Africa, China and america as a result of we’ve grown efficiencies and developed very excessive talent ranges,” Mehta enthuses. “Immediately, 9 out of 10 diamonds are minimize in India. It’s the one manufacturing space the place India has a monopoly and we’re part of that success story.”

A serious cause why the corporate has thrived over the past decade is by difficult conference.

Immediately, 9 out of 10 diamonds are minimize in india. It’s the one manufacturing space the place India has a monopoly and we’re part of that success story.

“We realized that the fashionable client wants extra customization, a novel trying diamond,” Mehta explains. “We began making much more totally different shapes that at the moment are our proprietary cuts and add extra worth to the stone.

“We weren’t simply branding jewelry, we had been branding diamonds as effectively, and that’s very fashionable proper now in america and Far East. That’s the place we’ve taken the best market share.”

The trade behemoths should still wield immense energy on the subject of getting the uncut gems out of the bottom and onto the market, however Blue Star Diamonds has proved that innovation and reacting speedily to rising developments can nonetheless achieve a major aggressive benefit.

Rising Diamonds

“The largest ever disrupter within the diamond trade occurred within the final three years – laboratory-grown diamonds,” Mehta reveals. “They’re the identical as mined diamonds, however take two billion fewer years to make! They’re not faux or synthetic, they’re actual diamonds with precisely the identical bodily properties.

“The rising course of was perfected over the past couple of a long time, and within the final three years, it grew to become cost-effective. Already in america, most likely 10 p.c of the diamonds bought have been grown in a lab.”

Lab-grown diamonds retail for between 20–60 p.c of the worth of mined diamonds.

[ad_2]

Source_link