[ad_1]

Try what’s clicking on FoxBusiness.com

A diamond is without end, however perhaps not for for much longer.

Spot buying and selling in commoditized clusters of diamonds began in September and the agency behind the digital trade goals to launch a futures contract subsequent yr on the Minneapolis Grain Trade. An exchange-traded fund is subsequent up in Diamond Customary Inc.’s plans to get the gems included within the indexes that steer commodity fund investments.

“That’s the inflection level our early buyers are ready for,” stated Cormac Kinney, founder and chief government of Diamond Customary, which has been shopping for about 10,000 diamonds per week and promoting plastic-encased, equally valued clusters to buyers.

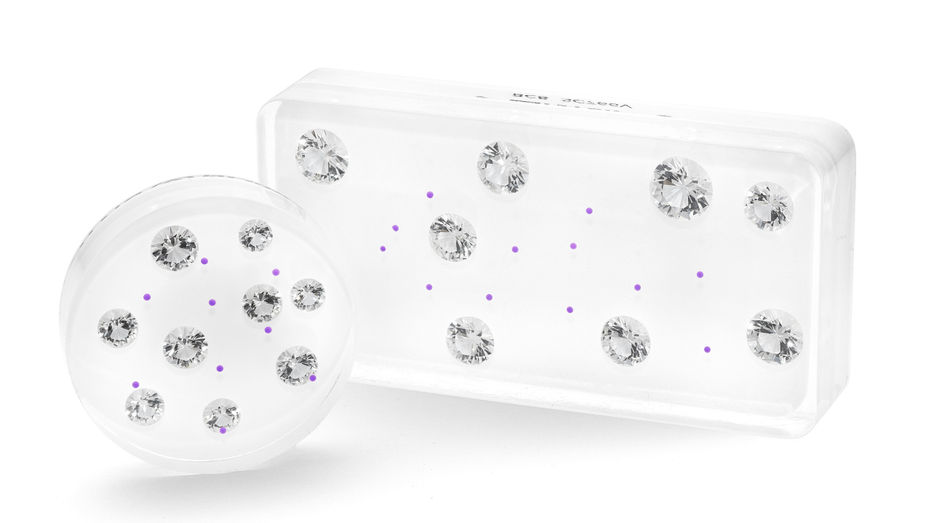

Diamond Requirements coin is displayed subsequent to forex for a measurement comparability. (Diamond Customary Newsroom)

AFFLUENT SPLASH OUT ON PREMIUM DRINKS, PRICEY BIRKIN BAGS BUT CLOUDS LOOM

Mr. Kinney is aiming for one thing much like what occurred when gold turned financialized. As soon as buyers might purchase and promote gold with out hauling round bars of it, commodity funds and others made allocations that elevated the worth of the valuable metallic to new heights.

ETFs and new futures contracts flop on a regular basis, to make sure. And functioning markets in funding diamonds have been elusive, regardless of investor curiosity that flares up in periods of excessive inflation, like now, when individuals are anxious to squirrel away wealth.

Shopping for diamonds is the simple half. The issue is promoting them, which the well-known De Beers promoting line about holding without end was meant to dissuade.

Diamond Bars, which shall be bought in a coming providing, shall be price 10 diamond cash. The futures contracts shall be for 20 cash, or two bars. (Diamond Customary Newsroom)

For one, many patrons pay retail however promote to sellers at wholesale costs, a lesson discovered within the Eighties by Individuals who had been bought diamonds by telemarketers pitching sparkly hedges towards the period’s inflation.

Although diamonds have dependably risen in worth over the many years, it might take years to make up for the markup. Lengthy holding intervals on ring fingers and in safes, plus competitors from jewelers for investment-grade stones, has restricted liquidity, or the power to transact at anticipated costs.

Diamonds are additionally idiosyncratic, with 1000’s of combos of shade, readability, carat and reduce, and normally valued by subjective appraisal. You’ll be able to reduce a gold bar in two and the halves will equal the entire, however two half-carat diamonds don’t add as much as a 1-carat stone.

WORLD RECORD PINK DIAMOND SOLD FOR $57.7M IN HONG KONG: ‘APPETITE FOR RARE’

Fungibility, greater than opaque pricing or illiquidity, is the most important hurdle for funding diamonds, stated Olya Linde, a Zurich-based accomplice at consulting agency Bain & Co., who makes a speciality of power and pure sources.

“If anybody solves that, that’s the primary massive step towards unlocking the funding demand,” she stated. “That is the place the true expertise, synthetic intelligence and machine studying, in all probability can are available.”

Mr. Kinney, a pc scientist, believes he has cracked the code to commoditizing diamonds. He has run a quantitative hedge fund and created and bought buying and selling packages and different software program, together with to Information Corp, which owns The Wall Road Journal.

| Ticker | Safety | Final | Change | Change % |

|---|---|---|---|---|

| NWSA | NEWS CORP. | 17.17 | +0.25 | +1.48% |

| NWS | NEWS CORP. | 17.37 | +0.36 | +2.12% |

He bought into diamonds when he met his spouse, Mimi So, a supplier of gems and designer of wonderful jewellery. Shopping for an engagement diamond for somebody like her was daunting. He had entry to a trove of market information from her enterprise and went about selecting a diamond the identical manner he approached quantitative buying and selling.

“I put collectively an enormous spreadsheet of various diamonds and analyzed how their value modified primarily based on carat, the colour, readability,” Mr. Kinney stated. “It was mainly to discover, what are the trade-offs that you’ve with a diamond? What makes the worth go up or down?”

He purchased a 5.01-carat D VVS1 diamond for his bride. A decade later, after constructing buying and selling programs and dealing on statistical arbitrage and optimization of issue fashions, Mr. Kinney returned to diamonds.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“He at all times questioned, ‘Why would the worth change a lot? Why if you happen to purchase one thing at one value, and the subsequent day you went to unload it, wouldn’t it be so totally different,’” Ms. So stated. “That was at all times laborious to reply as a result of it was extra who you knew or who you’d present it to.”

Mr. Kinney determined that the way in which to commoditize diamonds was to group them in equally valued clusters. To do this, he would wish to create a kind of yield curve that organized values by 1000’s of combos of traits, in order that diamonds might be organized in equal bunches.

The values had been continuously altering. The info set might by no means be accomplished. He determined he couldn’t write an algorithm to supply the curve. Diamond Customary would uncover costs as an alternative by shopping for 1000’s of diamonds.

The agency, which has Fifth Avenue places of work close to Manhattan’s diamond district, bought began final yr by elevating $75 million in an providing of its cash, utilizing the cash to purchase the stones that might go in them.

Priced at $5,000, every coin wound up with both eight or 9 stones, or between about 3.125 carats and three.4 carats. The stones are suspended in a disc of plastic resin together with a wafer that works like a credit-card chip and makes use of blockchain expertise to make sure authenticity. Bars, which shall be bought in a coming providing, shall be price 10 cash. The futures contracts shall be for 20 cash, or two bars.

The stones are suspended in a disc of plastic resin together with a wafer that works like a credit-card chip and makes use of blockchain expertise to make sure authenticity. (Diamond Customary Newsroom)

Diamond Customary now buys diamonds from sellers world wide as wanted to satisfy demand for its cash, that are minted in New York after the stones are examined by the Gemological Institute of America. Some patrons have cash delivered to their properties. Most are saved in a vault in Delaware, the place there isn’t a gross sales tax.

Cash just lately traded for $5,700 on Diamond Customary’s digital trade, and the typical unfold between bids and asking costs has been about 1%. That could be a lot lower than an public sale charge or the haircut sellers can count on on forty seventh Road, Mr. Kinney stated.

CLICK HERE TO GET THE FOX BUSINESS APP

Diamond costs rose in the course of the pandemic when competitors from fancy holidays and different experiential spending dried up. They exploded in the course of the bonanza of betrothal that adopted the lockdowns. “It went nuts,” stated Paul Zimnisky, who publishes a value index for tough diamonds. “Everybody was bought out.”

After reaching data early this yr, costs have declined. Although demand is threatened by financial uncertainty, China’s Covid-19 lockdowns and a extra regular tempo of engagements, Mr. Zimnisky stated sanctions on Russian diamonds and the dearth of main new mines ought to help costs.

If Diamond Customary’s cash take off, it should want numerous stones. Mr. Kinney stated he’s counting available on the market liquidity to encourage individuals who have been holding diamonds without end to lastly promote.

[ad_2]

Source_link